how likely will capital gains tax change in 2021

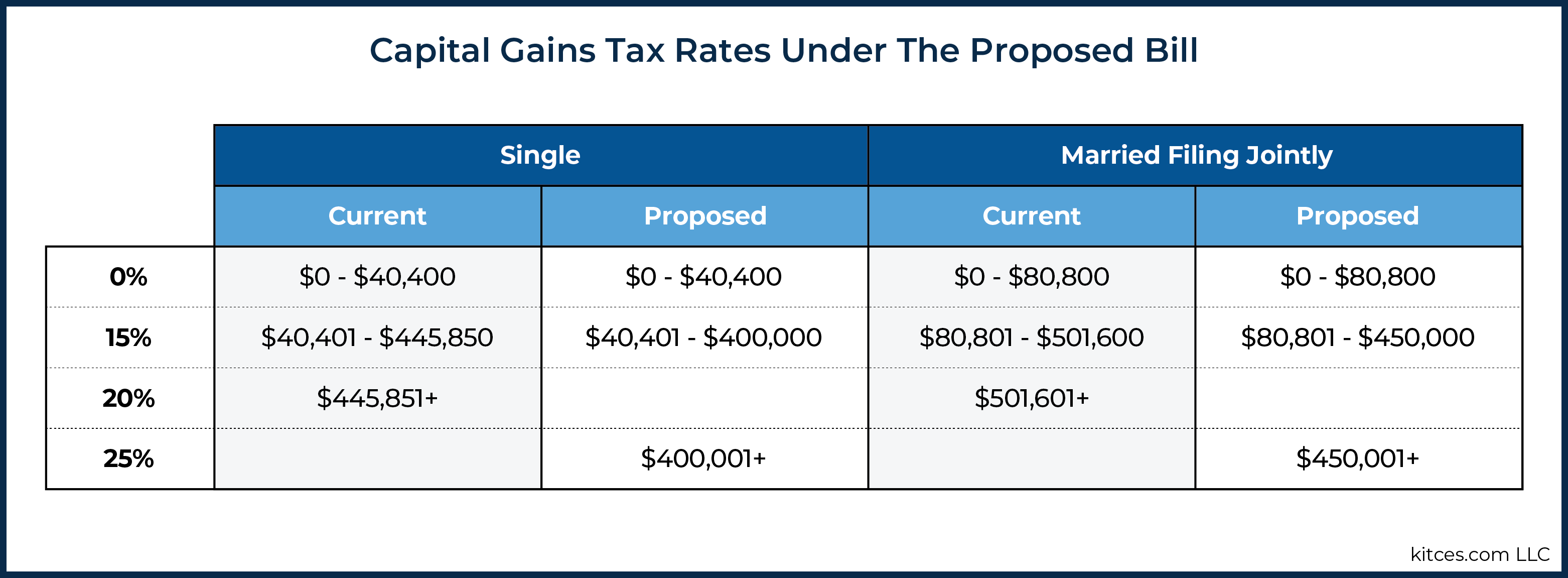

Potential Changes to the Capital Gains Tax Rate 4 days ago Jun 24 2021 The proposal would increase the maximum stated capital gain rate from 20 to 25. Congress could approve some sort of change to capital gains taxes sometime this year.

Managing Capital Gains Tax In 2021 And Beyond Ultimate Estate Planner

Passing such a change to capital gains rates is most likely to occur when Congress can turn its attention away from the COVID-19 crises.

. Long-term gains still get taxed at rates of 0 15 or 20. The effective date for this. The Budget is fast approaching on 3 March 2021 and there is speculation that the rates of Capital Gains Tax CGT a tax on the difference between an assets value at.

Democrats will likely drop hundreds of billions of dollars in proposed tax increases on the rich as they scramble to shrink the size of their. Capital Gains Tax UK changes are coming. The Chancellor will announce the.

Compressed tax rate schedule for estates and trusts Short-term capital gains taxed at 37 38 surtax if taxable income exceeds 13050 2021 Long-term capital gains taxed at 20 38. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. A key issue is whether the change would.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Business owners need to balance concerns about impending tax changes with considerations around maximising the value of their businesses before deciding when to sell.

4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25. 10082021 0430 AM EDT. With both the Senate and the House under Democratic control the Biden administration could potentially still make changes to the capital gains tax in 2021.

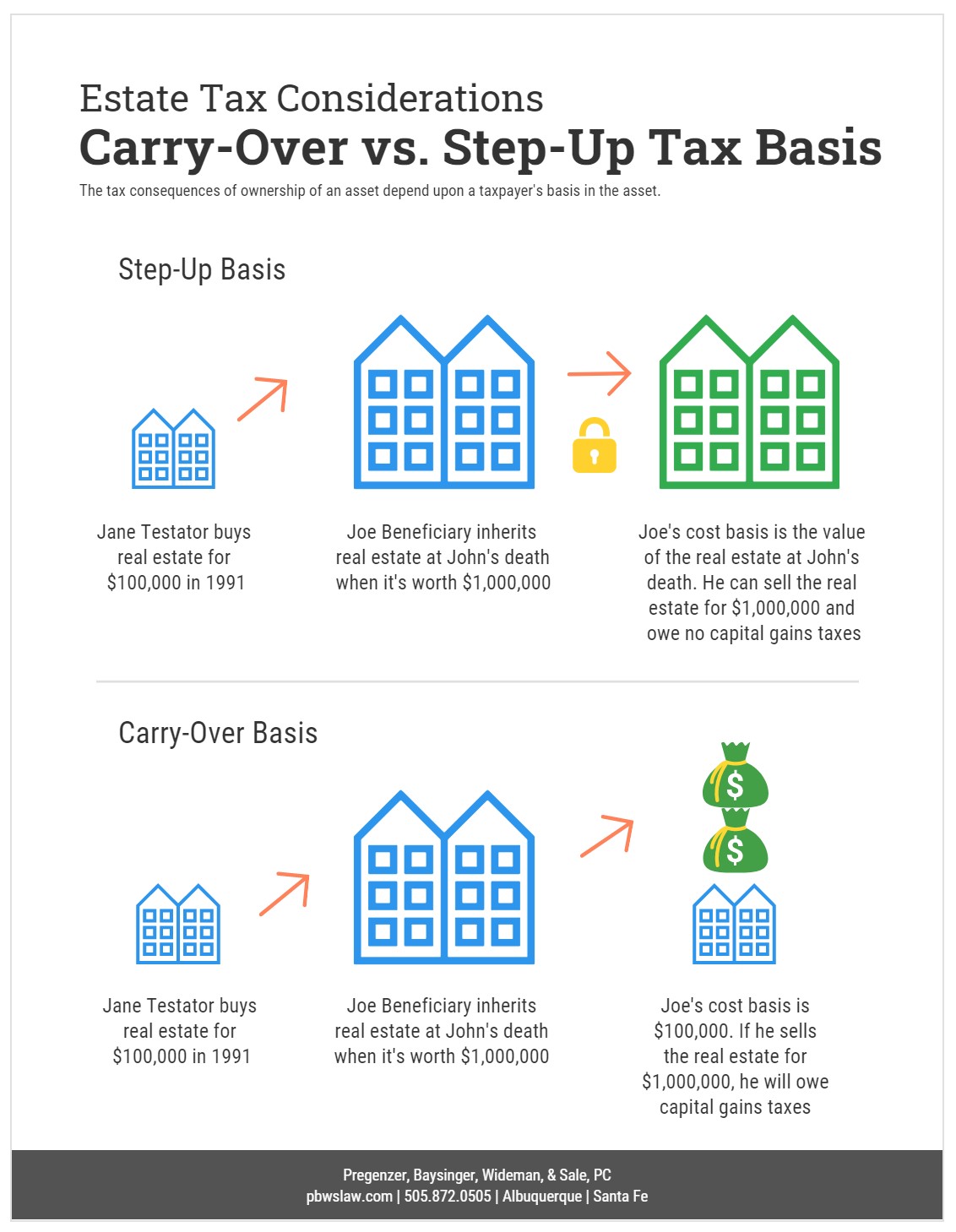

And if retroactive taking action now is not likely to be beneficial. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some.

Long-Term Capital Gains Taxes. It seems unlikely they will pass. However it was struck down in March 2022.

Long-term gains still get taxed at rates of 0 15 or 20. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Home Resource Center Proposed Changes to Taxation of Capital Gains.

Tax Changes and Key Amounts for the 2022 Tax Year. Changes to Capital Gains Tax 2021. Capital Gains Taxes on Collectibles.

President Biden and his administration have long indicated there would be a change coming to the way capital gains. However if you earn less than. Tax Outlook Capital gains tax changes.

Taxpayers subject to the net investment income tax pay another 38 currently and would continue to pay that after any of the proposed increases are enacted. If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of.

Estate Taxes Under Biden Administration May See Changes

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax Washington State Changes In 2021 Mainsail Financial Group

Capital Gains May Have Triggered More Individual Taxes For 2021

State Taxes On Capital Gains Center On Budget And Policy Priorities

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Capital Gains Tax Changes For 2022 The Jacksonville Business Broker

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Why Biden S Plan To Raise Taxes For Rich Investors Isn T Hurting Stocks The New York Times

Capital Gains Tax Definition Taxedu Tax Foundation

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Individual Capital Gains And Dividends Taxes Tax Foundation

Capital Gains Trade Nears Potential Deadline As Legislation Looms

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)